The Hidden Half of Your Social Security Tax

For most working Americans, Social Security is seen as a built-in part of life: a deduction on every paycheck, with the promise of income in old age.

What is never mentioned, and often unchallenged, is that this deduction, officially 6.2% of your wages, is only half the story. Your employer is legally required to match that contribution, bringing the total Social Security tax to 12.4% of your income. But where does that other half go?

Where Does the Employer’s money Go?

Unlike a private retirement account where contributions accumulate interest and build wealth, both the employee’s and the employer’s Social Security contributions are dumped into a general trust fund. That trust fund is immediately used to pay current retirees.

- There is no personal savings account, no growing nest egg, and no ownership of the funds.

- If you die early, your heirs receive little to none of what you paid in. 12.4% of your labor income effectively disappears into a government-managed pipeline with diminishing returns.

What Happens When the Money Runs Out?

The trust fund has already begun to run annual deficits. According to the Social Security Trustees, the Old-Age and Survivors Insurance (OASI) trust fund will be depleted around 2033. At that point, unless Congress acts, retirees will face automatic benefit cuts of about 23%. This isn’t a conspiracy theory. It’s an official government projection. And it raises a deeper question: Was this system ever truly sustainable?

Social Security: Designed with a Flaw?

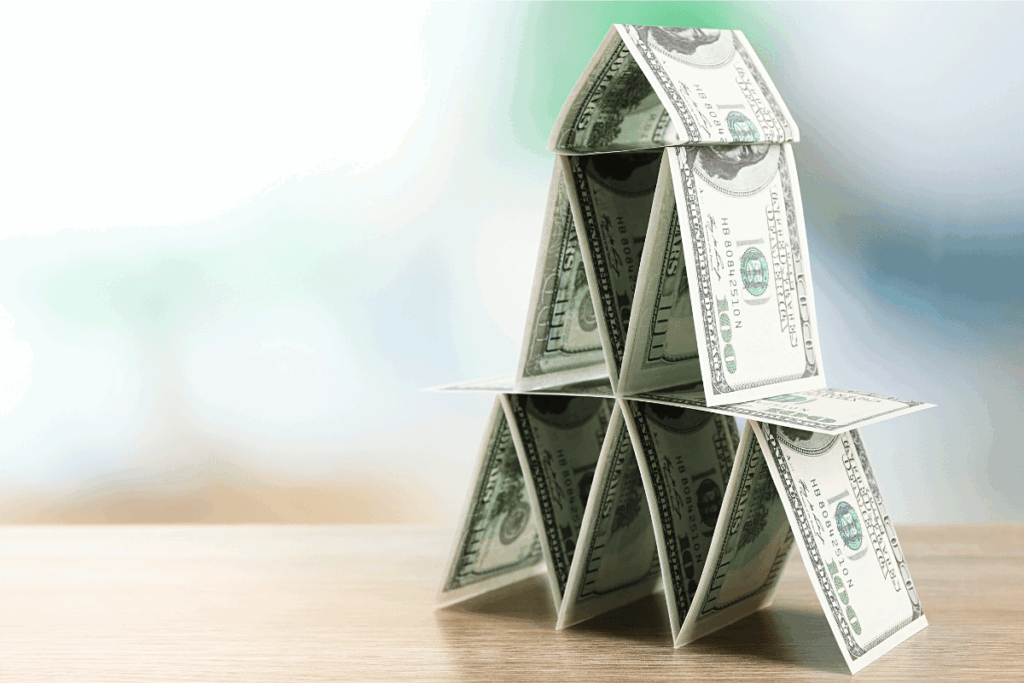

Social Security began in 1935 as a pay-as-you-go system. Early recipients, like my father, paid very little in and collected benefits for decades. He worked for 25 years and received benefits for 40. Multiply that by millions and you can see the structural flaw. It depends on a constantly growing number of workers to support a growing number of retirees, a pyramid structure that economists have long noted bears a disturbing resemblance to a Ponzi scheme.

What Did Americans Do Before Social Security?

Before the government took control of retirement planning, Americans relied on family, savings, church-based charities, mutual aid societies, and their own land or small businesses. Many worked longer, lived with extended family, or were cared for by their community. It wasn’t perfect, but it was personal and often more accountable. Importantly, people kept their earnings and controlled their destinies.

A Better Way: Privatized, Personal Retirement Accounts

Imagine if that 12.4% Social Security tax were invested in your name in a private account. With compound interest over 40+ working years, most Americans would retire with significant assets. These funds could be inheritable, portable, and invested with flexibility. Countries like Chile have implemented this with notable success, giving workers ownership and breaking the cycle of generational dependency.

Chile’s Privatized Model (Since 1981)

Type: Fully funded individual accounts (mandatory private savings)

Contribution: About 10% of worker’s wage goes into a private account

Control: Workers choose from licensed private pension fund managers (AFPs)

Returns: Tied to real investment returns (stocks, bonds, etc.)

Ownership: Funds are owned by the individual and are inheritable

Solvency: No national insolvency issue — depends on market performance and individual saving

Drawbacks: Risk of poor returns, fund managers fees, and inequality in contributions

The Bigger Picture: Welfare State vs. Wealth Creation

Since the 1960s, the welfare state has expanded alongside Social Security, but the poverty rate has remained largely the same. We now spend over $1 trillion annually on more than 80 welfare programs, yet dependency has grown, not declined. The lesson is clear: government systems redistribute, but they rarely empower.

Conclusion: It’s Time to Rethink Retirement

We need a system that respects personal responsibility, rewards saving, and trusts citizens to manage their own future. Letting Americans invest their own 12.4% would create wealth, reduce dependency, and ensure dignity in retirement. It’s time to stop pretending the current system works and start imagining the one we should have had all along. Keep in mind that Social Security distributions were never guaranteed.

Benefits Are Not Legally Guaranteed

- In the 1960 Supreme Court case Flemming v. Nestor, the Court ruled that you do not have a contractual right to Social Security benefits, even if you’ve paid into the system for decades.

- The Court emphasized that Congress retains the power to alter, reduce, or eliminate benefits at any time, especially in response to fiscal concerns.

Translation: There is no legal obligation for the government to pay out what you expected or what you’ve contributed.

If you liked this blog, then you’ll LOVE my books! Click on the image for more information about my latest book AMERICA’S DEMOCRACY BETRAYED…SOLUTIONS TO FIGHT BACK!

This is THE ONLY PLACE to receive EXCLUSIVE, AUTHOR-SIGNED COPIES when you purchase from www.salmartingano.com!

Extras:

Get a FREE ebook by joining our mailing list today!

We will send you a digital preview of Dr. Sal’s new book America’s Democracy Betrayed.