Central Bank Digital Currency… The Next Financial Revolution

The exchange of goods and services is the basis of all commerce.

The methods of exchange have changed from an individually controlled barter system, exchanging one person’s goods or services for an equivalent value of another person’s goods or services. Over time, the cumbersome nature of barter led to a universally accepted “currency” exchange, no longer individually controlled but controlled by a monetary “banking system.”

What Is Currency?

Currency is a medium of exchange for goods and services. It is money, in the form of coins or paper equivalent, usually backed by a universally valued entity like gold or silver.

- When currencies get corrupted by elite evildoers, newer and more secure currencies must emerge.

- In the 21st century, a new form of currency entered the realm of exchange: the “virtual currency”, also known as cryptocurrency.

- Virtual Currencies, like Bitcoin and Ethereum and now Central Bank Digital Currency (CBDC) have no physical form or government backing in the United States. They are traded and stored electronically. https://www.investopedia.com/terms/m/mediumofexchange.asp

Historical Reference for the Dollar Creation of the Bretton Woods System

In July 1944, a new international monetary system was adopted by delegates from forty-four nations that met in Bretton Woods, New Hampshire. The Delegates agreed to establish The International Monetary Fund, which became the World Bank Group.

- It was decided that countries would settle all international balances in U.S. dollars and that dollars would be convertible to gold at a fixed exchange rate of $35 an ounce.

- The United States had the responsibility of keeping the price of gold fixed and had to adjust the supply of dollars to maintain confidence in future gold convertibility. https://www.federalreservehistory.org/essays/bretton-woods-created

Nixon Ends Convertibility of U.S. Dollars to Gold and Announces Wage/Price Controls

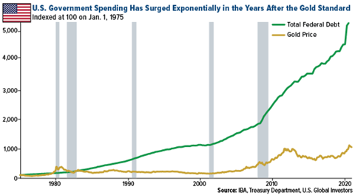

The Bretton Woods system remained in place until the US balance of payments deficits led to high inflation which exceeded the US gold reserve. The United States could not fulfill its obligation to redeem all dollars for gold at the official price.

- In August 1971, President Nixon took the U.S. dollar off the gold standard. https://www.federalreservehistory.org/essays/gold-convertibility-ends https://www.youtube.com/watch?v=nYYADywz3bg

- Before 1971, there was a natural limit to available dollars, dependent on the amount of gold sitting in Ft. Knox.

- Overnight, the dollar became a free-floating currency, measurable only by government spending and how much money could be printed.

To this day, the dollar is not backed by a hard asset but by the “full faith and credit of the U.S. government”. The federal debt is closing in on an astronomical $30 trillion, which is more than 130% of the size of the U.S. economy.

- In real terms, today it takes $7.81 to purchase the equivalent of what $1.00 would purchase in 1970.

What is FedNow?

FedNow is a payment service available to banks and credit unions interested in real-time services. The FedNow service is not a form of currency, so it can’t replace cash. It is a “real-time” payment system between banks built and operated by the Federal Reserve. https://www.stlouisfed.org/open-vault/2023/october/five-things-about-fednow

- Banks using the service can send and receive payments in just seconds anytime, 24 hours a day, seven days a week.

- FedNow eliminates the need for PayPal or Zelle.

- It modernizes the U.S. payment system by allowing banking customers to send and receive payments in near real-time. https://youtu.be/7lC8oiqCVps

What Could Go Wrong?

The Federal Reserve itself says the government will not have access to individual accounts and cannot “control how they choose to spend their money,”

- The Fed will, however, have access to any and all information allotted to them by participating institutions. If this is abused, no longer will people have the luxury of private transactions

- The government will be privy to every deposit you get from work, every Amazon purchase, and each and every sale you make on Facebook Marketplace, eBay, Target, and more

- If the Fed deems you are noncompliant with their environmental, social, and corporate governance rules (ESG), they can freeze your account and your ability to buy products or withdraw cash, like the Canadian equivalent system did to silence the truckers protest? https://fee.org/articles/what-s-wrong-with-fednow-everything/

Central Bank Digital Currency

CBDC is said to be necessary to stabilize the dollar. This is basically a lie because 114 countries are exploring digital currencies in an attempt to create government-controlled, central bank universal cryptocurrencies, available in electronic form only.

Advantages of CBDCs

- Proponents of CBDCs state that they would lower costs, offer greater transparency, and improve efficiency for payment systems

- CBDC could also help improve access to financial services, particularly in developing regions of the world that have limited or unreliable banking services

- CBDC would eliminate inflation caused by the intentional printing of fiat currency

Disadvantages of CBDCs

- The problem is that there is no limit to the level of control that the government could exert over people if money is purely electronic and provided directly by the government.

- A CBDC would give federal officials full control over the money going into and coming out of every person’s account including how much you can spend, purchase or send

- CBDCs provide huge surveillance capabilities through the ability to track, monitor, and control all financial transactions on the CBDC’s network

- Gives the government the ability to freeze or blacklist anyone using their system

- Government can prohibit you from spending your money if you disobey any present or future government policy like: mandatory vaccines, purchasing gasoline, buying meat, restricting travel or government enacted ESG scores

- CBDC’s are vulnerable to cyber attacks, requiring complex consumer protection

130 countries are presently exploring a shift to CBDC. In 2023, 64 countries are in the advanced phases of implementing a CBDC https://www.atlanticcouncil.org/cbdctracker/

Countries like Cuba and Nigeria have fully implemented CBDC’s with disastrous results. Cuban citizens are restricted to $20/day cash withdrawal while Nigerian families are restricted to $225/week

Top financial gurus in the U.S. state: “We must be prepared for the imminent CBDC takeover of our economic and banking system and the uncertainties that will surely follow”

If you liked this blog, then you’ll LOVE my books! Click on the image for more information about my latest book AMERICA’S DEMOCRACY BETRAYED…SOLUTIONS TO FIGHT BACK!

This is THE ONLY PLACE to receive EXCLUSIVE, AUTHOR-SIGNED COPIES when you purchase from www.salmartingano.com!

Extras:

Get a FREE ebook by joining our mailing list today!

We will send you a digital preview of Dr. Sal’s new book America’s Democracy Betrayed.